does new hampshire have sales tax on cars

New Hampshire does collect. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

New Hampshire Bills Of Sale Facts To Know Templates To Use

If a vehicle sales tax applies the vehicle seller must collect the tax when the sale transaction occurs.

. New Hampshires tax system ranks 6th overall on our 2022 State Business Tax. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax. New Hampshire does not have sales tax on vehicle purchases.

New Hampshire also has a 760 percent corporate income tax rate. Have an agreement with a solicitor for the referral of Minnesota customers for a commission and your gross receipts are at least 10000 over the course of 12 months. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

New Hampshire is one of the few states with no statewide sales tax. This week Governor Chris Sununu launched a special legislative session to craft a new bill to try to slow or stop other states from forcing New Hampshire businesses to collect a. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

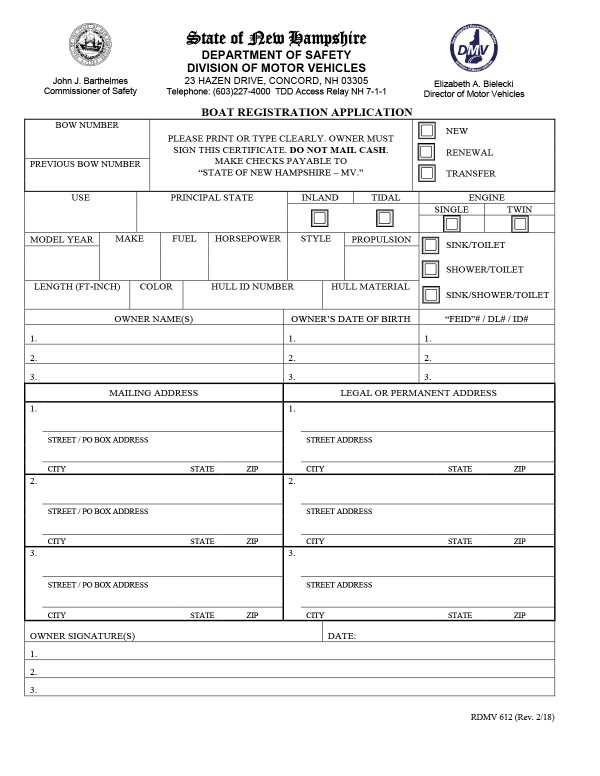

So New Hampshires tax. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. When Sales Tax is Exempt in New Hampshire.

Therefore the Department does not issue Certificates for Resale or Tax Exemptions nor does the Department issue tax exempt numbers. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. The State of New Hampshire does not have a general sales and use tax.

The NH sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. No inheritance or estate taxes. Similar to income taxes payroll.

New Hampshires sales tax rates for commonly exempted items are as follows. The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax. New Hampshire EV Rebates Incentives.

Property taxes that vary by town. However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states.

No capital gains tax. New Hampshire is one of the five states in the USA that have no state sales tax. While states like North Carolina and Hawaii have lower sales tax rates below 5.

There are currently nine states without income tax. There are however several specific taxes levied on particular services or products. The State of New Hampshire does not have an income tax on an individuals reported W-2 wages.

A tax rate of zero can equal a lot more cash staying in. These five states do not charge sales tax on cars that are registered there. As of 2020 while New Mexico charges sales tax on most goods it charges a lower tax on cars.

15 12 9 6. For more information on motor vehicle fees please contact the NH Department of Safety Division of Motor Vehicles 23 Hazen Drive. This is tax evasion and authorities are cracking down on.

Does New Hampshire chage a sales tax when buying a used car. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Does New Hampshire have sales tax on cars.

The Granite States low tax burden is a result of. New Hampshire does not have a state sales tax and does not levy local sales taxes. Alaska Delaware Montana New Hampshire and Oregon dont impose any state sales taxes.

A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus. The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. What states have the highest sales tax on new cars.

No there is no sales tax. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and. The tax is 76 percent for periods ending on or after December 31 2022.

There are however several specific taxes levied on particular services or products. Deliver items into Minnesota in your own vehicle. However if you go to tr.

Only a few narrow classes of goods and services are taxed eg. New Hampshire has a flat 500 percent individual income tax rate which is levied only on interest and dividends income. Should a company refuse to sell to you because you do not have a New Hampshire tax exempt number you may refer them to the New Hampshire.

If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car. Answer 1 of 3. New Hampshire does not have state or local sales tax or any sales tax laws.

Prepared meals hotel rooms cigarettes motor fuels medical services thats all thats coming to mind off-hand. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. New Hampshire is the only state without either a sales tax or income tax except Alaska but Alaska gets a huge amount of revenue from the oil and extraction industries.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. Most states have car sales tax exemptions especially for cars made before 1973 gifted vehicles and disabled owners. Are there states with little to no sales tax on new cars.

New Hampshire State Police Police Cars New Hampshire State Police Us Police Car

New Hampshire Bills Of Sale Facts To Know Templates To Use

Personal Vehicle Not Commercial

Free New Hampshire Bill Of Sale Form Pdf Word Legaltemplates

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Free New Hampshire Bill Of Sale Forms Pdf

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Do You Need Car Insurance In New Hampshire

New Hampshire Bills Of Sale Facts To Know Templates To Use

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Is Buying A Car Tax Deductible Lendingtree

Advertising For The 1955 Willys Bermuda Hardtop Automobile In The Portsmouth New Hampshire Herald Newspaper February 3 1955 Willys Advertising Car Ads

Nj Car Sales Tax Everything You Need To Know

Average Cost Of Car Insurance In New Hampshire For 2022 Bankrate

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Bills Of Sale Facts To Know Templates To Use

Dozens Of Cars Pileup In New Hampshire Just Over Massachusetts Border As Roads Turned Into An Ice Rink Christmas Morning