salt tax deduction california

For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the. California Approves SALT Deduction Cap Workaround.

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Joe Manchin D-WVa on Sunday again declined to speculate about backing President Joe Biden in 2024 and said he was hopeful Sen.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

. 10000 federal cap on the state and local tax SALT deduction a. California SB104 seeks to. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid.

Home Insights California Passes SALT Cap. Winegarden notes Congress didnt increase Californias tax burden Sacramento politicians did. Now Californians knows how much.

California Governor Gavin Newsom signed Assembly Bill 150on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass-through entities. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its residents to mitigate the effects of the 10000. Josh Gottheimer the Bergen County Democrat even.

Following the Tax Cuts and Jobs Act TCJA passed in December of 2017 high tax states such as New York New Jersey and California have been working on legislation that would reduce the impact of the newly enacted state and local tax SALT deduction limitation. The measure bypasses the 10000 per. On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE.

In a post-Tax Cuts and Jobs Act world your taxable income is. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either. People that resided in high tax states such as California found themselves leaving deductions on the table as they frequently paid far more than 10000 in SALT.

It once provided significant tax relief in states like New York and California where the local tax burden is heavy. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass-through entities PTE from the current individual annual 10000 limitation on the deduction against federal taxable income for state and local taxes SALT paid. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA. Prior to the TCJA individual taxpayers were able to personally deduct 100 of the state and.

Since the passing of the Tax Cuts and Jobs Act TCJA in late 2017 numerous states have enacted a workaround to the state and local tax SALT deduction cap of 10000 by allowing entities to be taxed at the entity level for their state taxes. Now SALT deductions are capped at 10000 the same for single and married taxpayers. California does allow deductions for your real estate tax and vehicle license fees.

For many Californians and other taxpayers located in high-tax states like New York and New. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. July 16 2021.

California does not allow a deduction of state and local income taxes on your state return. As we all know the Tax Cuts and Jobs Act of 2017 TCJA essentially eliminated the state and local tax SALT deduction availabe to individual taxpayers capping the amount deductible to 10000. The workaround however limits the number of qualifying entities by excluding partnerships that are owned by other partnerships.

Kyrsten Sinema D-Ariz will come on board with a Democrats. The SALT cap ended this unfair subsidy of high tax states by taxpayers in low tax states. Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately.

California Governor Gavin Newsom signed into law budget legislation that includes a workaround of the 10000 federal cap on state and local tax SALT deductions implemented under the Tax Cuts and Jobs Act TCJA. What Is the State and Local Tax SALT Deduction. For many top elected New Jersey Democrats restoring SALT the ability to fully write off state and local taxes was a rallying cry.

Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local. Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their tax payments.

15 hours agoAfter 2017 you can only claim a 10000 deduction for state and local taxes halving your SALT deduction. This article provides an overview of the California Pass-Through Entity Tax PTE which CPAs need. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

The State and Local Tax deduction encourages California to tax and spend more subsidized by low-tax states.

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Are Itemized Deductions And Who Claims Them Tax Policy Center

This Bill Could Give You A 60 000 Tax Deduction

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Coping With The Salt Tax Deduction Cap

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What Is Salt Tax Deduction Mansion Global

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

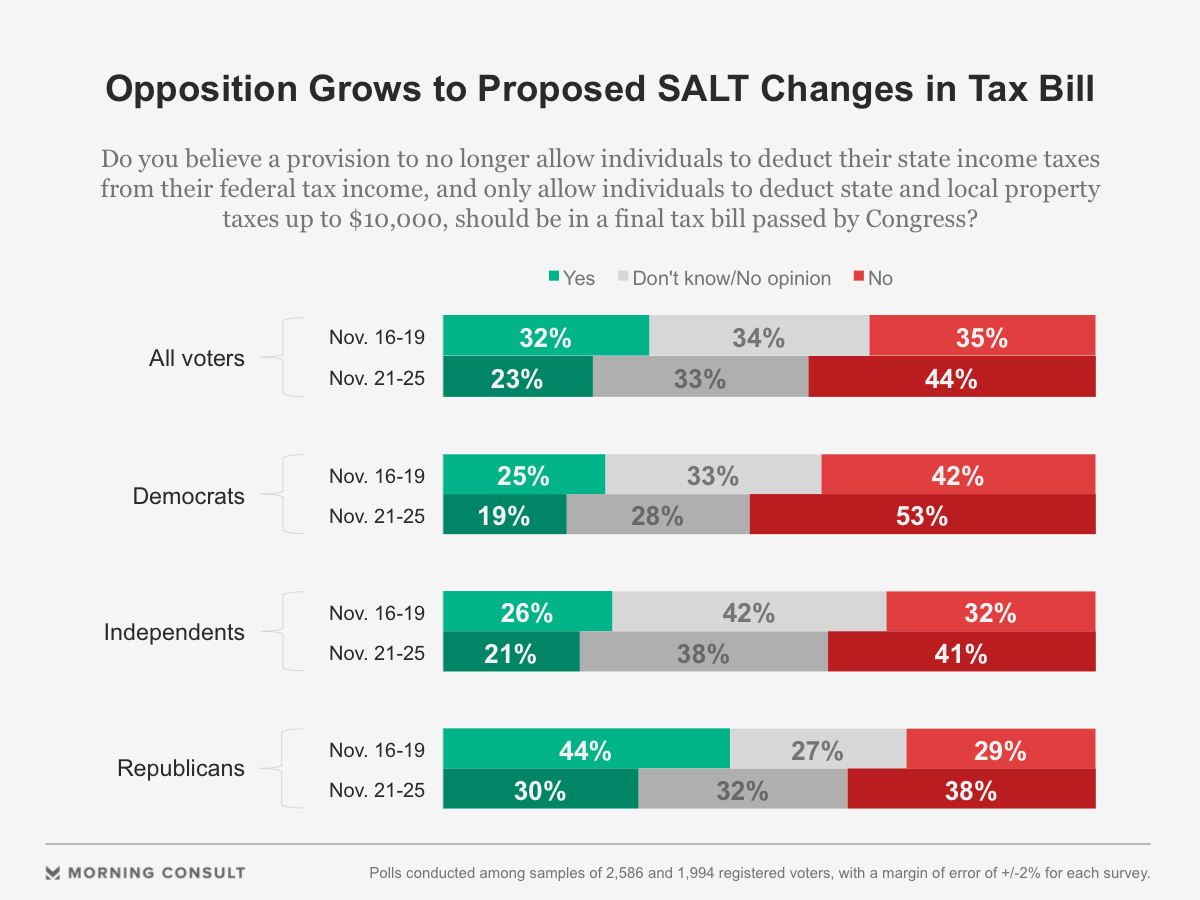

Voters Increasingly Oppose Proposed Salt Deduction Changes

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)