arizona charitable tax credits 2020

Military Family Relief Fund Credit limited to 1M in. I give to schools for their tax credits can I give to this tax credit too.

Charitable Tax Credit United Food Bank

2020 limits are quoted.

. This credit is limited to the amount of tax calculated on your Arizona return. A credit of up to. When you make a donation to St.

The maximum allowable credit to Qualifying Charitable Organizations is 800 for married filers and 400 for single filers married filing separately and heads of household filers. Credit for Contributions to a Qualifying Charitable Organization QCO Single taxpayers. To claim the QFCO tax credit use Forms 352.

There are four major tax credits that you can use to offset certain charitable donations in Arizona. 800 Married 400 Single Qualifying Charitable Organizations Qualifying Foster Care. What is the Arizona Charitable Tax Credit.

The Arizona Charitable Tax Credit gives taxpayers more choice in how their tax dollars are allocated. You do not need to itemize deductions to claim a tax credit for qualifying contributions. Below youll find links to information and donation pages for six different AZ eligible tax credit options.

For all of them you have until April 15 2021 or until the date you file. One for donations to Qualifying Charitable Organizations QCO and the second. Arizona Credit for Donations Made to Qualifying.

Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in Healthcare AZAIH PO Box 5157 Goodyear AZ 85338. Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. Certain itemized deductions including property tax qualified charitable.

Visit the Arizona Department of Revenue website for more information about state income tax credits for charitable contributions in Arizona or call us at 602-930-4452. Consider the example of a single taxpayer who makes a 400 donation to an eligible. In this scenario these two tax credits would reduce the individual taxpayers liability by 900 400 500 from 1200 to 300.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations. Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return up to 400 for. Yes the Arizona Charitable Tax Credits are.

The individual would end up paying 300 to the State of. The credit for fees or donations to public schools made between January 1 2023 and April 15 2023 can be claimed either on your 2022 or 2023 Arizona tax return. Be claimed on your 2020 tax return.

Cases a tax credit provides you with a greater positive financial impact. Any economic impact payments you received are advance payments of the recovery rebate credit.

2020 Parish Slide Fall 2020 English Final Catholic Education Arizona

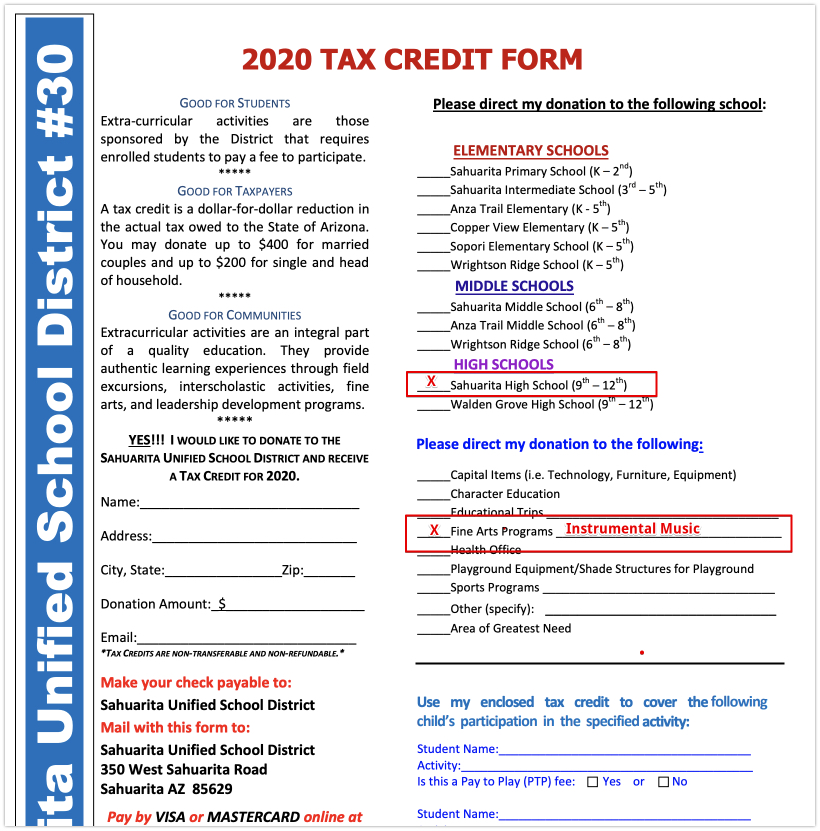

Az Tax Credit Information Sahuarita Music

Nancy Shonka Padberg Mba On Twitter Arizona Cfos And Ceos Join Us On June 11 For 30 Minutes To Learn How Az Corporate Tax Dollars Change Lives Education Underserved Arizona Sto Taxcredit

Arizona Tax Credit Alert 2022 Beachfleischman Cpas

Tax Credit Contributions Tax Credit Information

What Is The Arizona Tax Credit Program Esperanca

Az Charitable Tax Credit Foster Care And Charitable Tax Credit

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Contribute Arizona Charitable Tax Credit Catholic Education Arizona

Arizona Charitable Tax Credit Donations St Mary S Food Bank

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Arizona Tax Credits Millions Go To Foster Care Program Who Benefits

Arizona Tax Credits To Christian Organizations Charitable And Foster Care